Buy Weed (Finale)

So here we are three months later recapping some Pot Stocks we took a look at back in September. We looked at GW Pharma, mCig, and MedBox and all three have made some significant changes since we last saw them, unless you've been trading them. If You've been keeping up with these stocks or trading them then you probably made some good money from my predictions.

2014 saw the stocks price rise to new all time highs of around $9.00/share, At that point the market took profits and the technicals carried the price the rest of the way down to $5.47. That's still a higher price than the beginning of the year which brought the stock into the 2014 market at around 3.4499/share. That's roughly 59% in gains for the Pot stock which is nice but one could also look at the stock's all time high of $9.00 which is a nearly 161% increase in share value!

Next Up We have

This stock took a wild ride rising to a high of over .9000 before crashing back down near the year's open. Recently the stock has broken below an important support price .1481 and its looks like the market will keep the price below this level. We can't expect to see the price the stock to begin to rise until after the market picks up old orders from the next support level around .0873. Although the market hasn't provided much growth for this stock it has given it some; with a 2014 open of .1000 to today's price of .1290 which is a 29% rise in share price with only 1 day of trading left in the year.

Last and certainly least

Opened the 2014 trading year at 21.2400 and reached an awesome yearly high of $93.50/share. That's a 340% gain but we all know the markets are rarely that forgiving and the price eventually fell. As of late we have broken below a very important support level at 8.11 lowering the price to the lowest prices in nearly 2 years. This stock is the only to actually have a negative return ending the year with a 38% loss.

So we now know a few things about the developing Pot Stocks Sector. The vending machine method of dispensing marijuana is not a big seller so far. The UK is making some promising marijuana companies; and we know that These stocks provide traders with Q1 and Q2 trading opportunities as it seems these companies receive considerable capital inflows during those quarters of the year. I would look for buying the winning companies going into 2015 from their support levels. I would look for strong rallies to sell into, basically accumulate & distribute according to the rallies and sell-offs. We did well managing a 2:1 win:loss ratio and returns near 152% between just 3 stocks in1 sector of a portfolio.

Alibaba 90-Day Review

Alibaba (BABA):

Has grown to become China's largest company and is now taking over the rest of the world. Since the stock's initial public offering the price of the stock has risen around 15%. Lets take a moment to review this stocks 90 day performance.

We can see that the market carried the price to an all time high of around $120/share then immediately see the price fall to support of $101.20/share. That provided us with some information we can use to trade this stock in the future and forever. We are actually witnesses to this stock's historical highs and lows which will serve as psychological price points. Going forward we can see that the stock have to break above $120 to be considered for a 2016 distance runner and on the other side of the perspective we would have to see the market carry this stock below 101.20 before we could consider shorting this stock for anything more than a day trade.

(We now have long-term trend-line support)

In my opinion the best move is to buy on distribution dips all the way into $104.99/$105.00 with a stop-loss just under $101.20. An initial profit target should be $120 as it serves as our historical all time high for this stock. A breakout from there will indicate the market loves this company and it will continue to price in new highs throughout 2016.

Hottest Stocks Before Christmas

Looks as if the market is not interested in the Woodlands, Texas based electronics and appliance maker. The stock has been controlled by the bears for some time now and it doesn't look like they're letting up anytime soon. Obviously a sell is the best move and I see 26.58 being the perfect level to find some resistance for a fall back down towards the lows we're at now 14.85. From there we should see the market carry the price lower towards 12.99 and to another extreme low of 9.96. The chart below explains the story better.

Yum Brands Inc. (YUM):

Since our last review of this stock it has done as I expected and touched every support and resistance line in a wide range that has left the stock with no sentiment and hella volatility. As of now the price has fallen dramatically from a resistance check at 78.27 and right now is just above another support level of 70.16. This isn't all unexpected as we see 71.30 as the price that was supposed to support the stock today but failed and will not be tested as resistance which is where I would look for a selling opportunity, If this price is a good enough resistance I will hold until 70.16 is tested and if that price is broken then I'm holding on for another test of 68.90.

Since our last review of this stock it has done as I expected and touched every support and resistance line in a wide range that has left the stock with no sentiment and hella volatility. As of now the price has fallen dramatically from a resistance check at 78.27 and right now is just above another support level of 70.16. This isn't all unexpected as we see 71.30 as the price that was supposed to support the stock today but failed and will not be tested as resistance which is where I would look for a selling opportunity, If this price is a good enough resistance I will hold until 70.16 is tested and if that price is broken then I'm holding on for another test of 68.90.

Spirit Airlines (SAVE):

The stock has been a favorite of the market seeing the price rise substantially this year with a recent high being reached around $85/share. Recently though, the market has poured out a bit of its shares pulling the price back down towards 67.87 and 68.63 where we are now. To keep consistent with the trend we should look for a sell down towards 61.61 and that opportunity might be best exploited from resistance at 74.13. If that move is voided we should wait for the market's reaction to 61.61 which might bring in heavy bulls that could prop the price up and continue the overall uptrend.

Petroleo Brasileiro (PBR):

Recent oil price suppression has caused the company to fall apart. With no floor in sight and no events to stop the bleeding the company is experiencing some serious outflows of capital in the public markets. A good price to sell from is 8.91 as it looks to be the most recent level that could provide us with some resistance.

Recent oil price suppression has caused the company to fall apart. With no floor in sight and no events to stop the bleeding the company is experiencing some serious outflows of capital in the public markets. A good price to sell from is 8.91 as it looks to be the most recent level that could provide us with some resistance.

If it isn't held we can expect to see profit takers and contrarian traders carry the price up to 10.21 before they are battered back down to 8.91 and then to the 6.25 lows we are experiencing currently.

December's Top Stock Picks

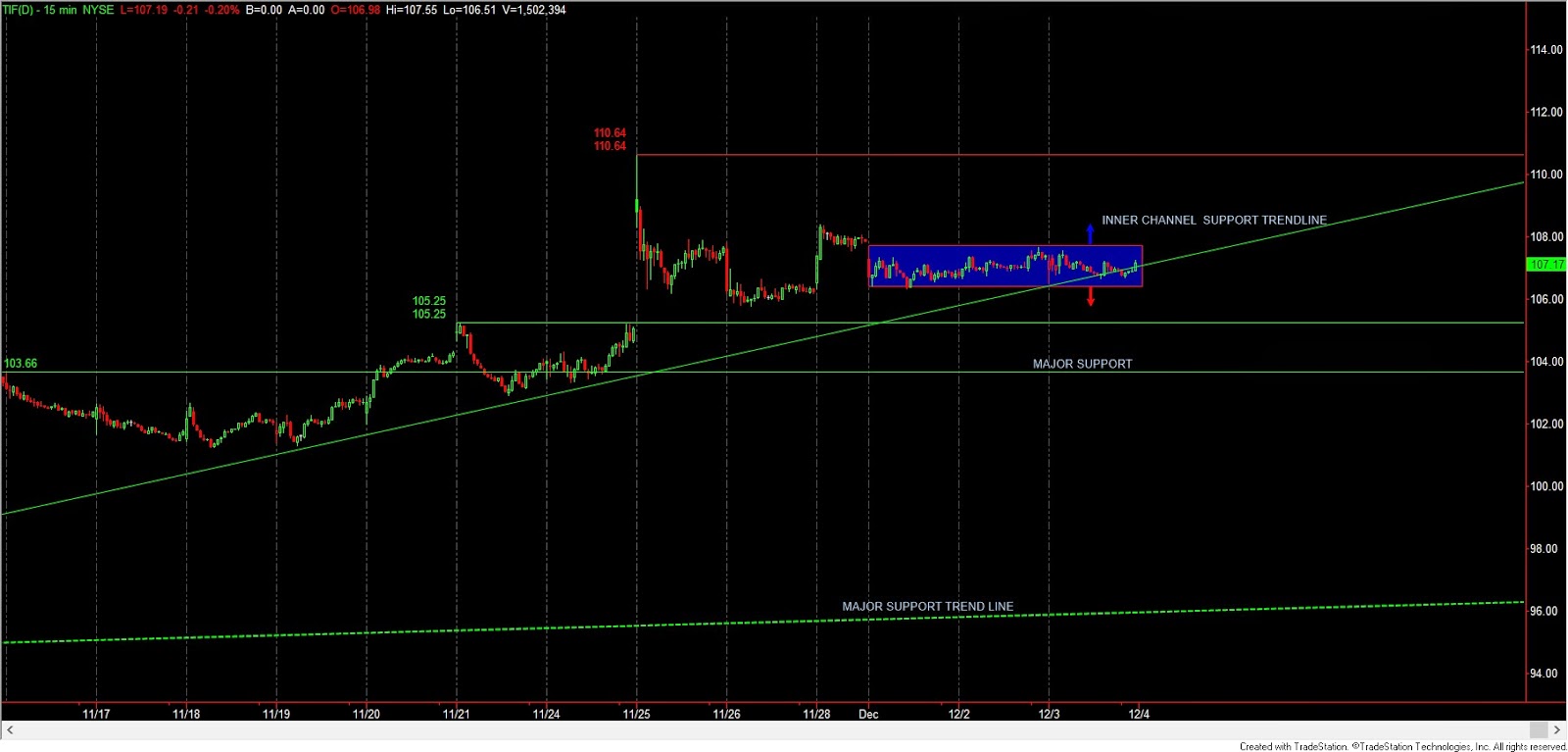

Seems as if this stock has been ranging since the beginning of the week, where Monday we saw a small gap lower. The pair is supported by two support trend-lines. A major trend-line which dates back over a month and an inner channel support trend-line. The nearest support is 105.25 and interestingly the major support is at 103.66; The next resistance is 110.64 which is also the most recent highest high dating back from November 24th. I see this pair falling to support if the range low is broken but on the contrary I see the stock elevating to test the resistance/highest high.

The sell-off is real. This stock has been sold off heavy for the past few years but that doesn't mean there aren't any opportunities to catch a counter trend trade which we all know can be violent and volatile which can be beneficial to good traders. Near term support us 18.13 which coincides with the trend-line support. The pair gaped lower to start the week falling from 18.79 which it has almost completely filled at this point. 18.79 is now acting as resistance and the market could see some nice gains if this price is overtaken. On the other side of this instrument we can see the major support is 17.28. If a trader takes this trade from 18.13 they can look for a profit target at 20.28; 18.79 broken is confirmation. If it is held then look to sell from the resistance.

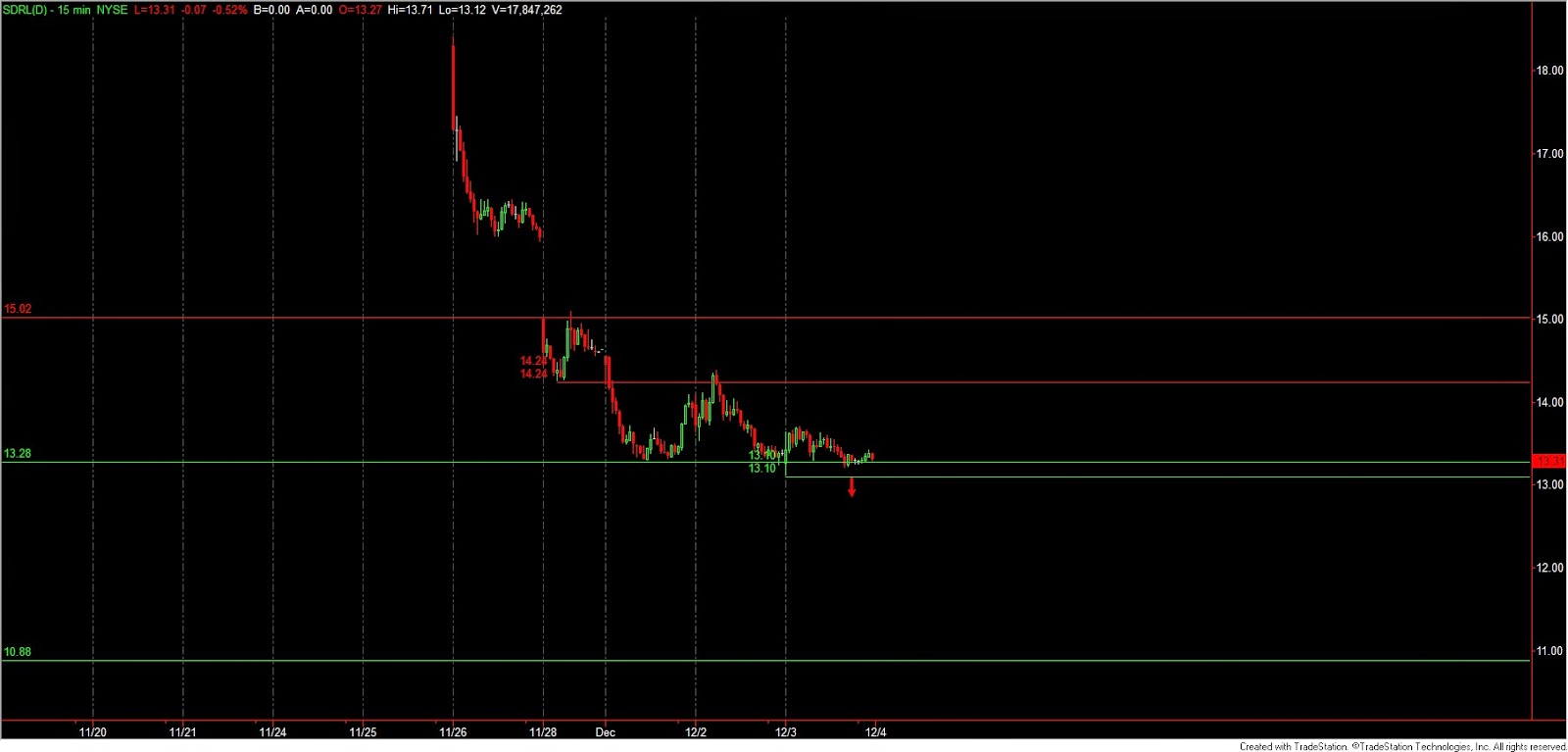

On a slow stroll lower this stock has now found a bit of support. As of now 13.28 is acting as support but 13.10 is the low that needs to be broken before we can see a serious breakdown. If this happens we can expect to see the market lower the price to around 10.88. If support is held then we can expect to see the market carrying the price up around 14.24 which is near term resistance. If this price is broken we can see a further rally towards 15.02. If 14.24 is held we can expect to see the price fall back to the current level creating a wide range.

The market created a gap from 2.85 to around 3.50 but the market turned around and filled that gap over last week and this week before reaching 2.85 which turned into support. Now we are seeing the stock jump up & down and today it found support at 2.98 and resistance at 3.16. We can now anticipate the market sustaining the trend line support and carrying the stock higher. A break of 3.06 should take us to 3.16 and a break of that resistance will carry us to medium term resistance at 3.39. If either 3.06 or 3.16 caps the stock then we can expect to see the price fall back to 2.85.

I'm pretty excited about this stock because not only is it about to make a major move but the move will confirm the pattern identified by yours truly. on the 15min chart below we can see that the stock was moving higher sharply and reached a pinnacle where it stuttered and got slammed down. The market tried to push the stock back up but got rejected at 120.19 where is carried the stock to 118.56 which it tried to use as support but ultimately was moved lower. Now we have a situation where the markets closed just below 118.56 which was support and now looks like it will be used as resistance. I know all of that may sound like nothing but in an illustration we can see the what's really going on.

Yes...Your eyes are not deceiving you, you are looking at the coveted and almighty Head & Shoulders Pattern. I suggest selling this stock from 118.56 with the anticipation of seeing the arm lower matching the arm that created the first shoulder. From 118.56 I see the stock moving much lower very quickly towards once resistance and now support of 112.14. December is riddled with holidays and traders want to lock in profits before those days so they tend to make decisions with conviction which spells out viscous relentless trends and in the case of this stock, a trend lower.

This is my present to you for the holidays. Happy Hannukah =)

EURJPY Profit Report

EURJPY made it on to my Trades Worth $1,000,000 post back on September 30th. Looks as if I was correct. The market carried this trade from lows of 136.000 to highs of nearly 145.000. Although our final profit target was 145.701, I won't feel bad missing out on 70 pips when I closed the trade for a total gain of 447.3 pips. I made 4 trades for a combined position size of 4,000,000 units or 40 standard lots. That earned me a $165,010.60 profit on a $99,446.40 investment but of course that's with margin included so my actual investment was $9,424.02. That's a 1751% return in just 1 month and 14 hours.

This 240min chart shows the price path as it performed over the past 30 days.

The highlighted blue rectangles are where I entered the trades, where I took profits and where I closed the trades for an exit out of the position. The white dashed lines show the direct path the trade took.

The white dashed lines show the direct path the trade took.

The white dashed lines show the direct path the trade took.

The white dashed lines show the direct path the trade took.

This equity curve line shows the path of profits from entry to exit.

USDJPY Long: Completed Over $200k in Profits

I'll take the time to go over the USDJPY Position I just closed.

I entered this trade on September 5th 8:30AM(EST) with a buy at 104.91 for 500,000 units or 5 standard lots. That moved to 110.00 on the 30th of September where I took profits on 250,000 of the original 500,000 units for a profit of $11,697.48 in just 25 days leaving me with 250,000 units.

During The volatile conditions the market created a leg where I bought 1,250,000 more on October 14th at 107.22 and 2,000,000 units more a week later on the 21st at 106.70. That brought my total investment up to 3,500,000 units or 35 standard lots. The price resumed higher from those temporary lows. On October 31st (Halloween) I sold 1,750,000 units at 112.07 for a profit of $81,883.77 for a total of profit of $93,581.25 over the course of a little less than 2 months. Just five days later on November 5th 9:03PM(EST) I closed the entire position because it hit my final target of 115.00 which on 1,750,000 units gave me a profit of $126,166.35 bringing my total profit to an awesome $219,747.60.

I spent a total of 2 months,12 hours and 33 minutes in this series of 5 trades. The average return per trade was over $40k and the return on capital was 221.27%. The average monthly return over that time period was $74,036.43.

Silver and Gold For The Future

Gold and Silver have been low for the last year or so and instead of being concerned about the prices of these precious metals I'm more concerned about why people aren't buying the metals up by the ton.

SILVER (XAGUSD):

Since its inception into the FOREX markets the precious metal has been down-trending against the USD. Our daily chart shows us that we have a few good opportunities for short term trades while looking to the long term horizon for buying low...lower than its price has EVER been.

For some immediate trades I would look to sell from around 16.656 to our all time low at 15.056. If the price decides to extend its rally then I would be looking to sell between the prices 18.175 and 16.705. On the other side of the silver coin we could look to go long when our indicators start shedding light on a potential reversal that I don't see coming until early 2015 and at the earliest late into December of this year.

For some immediate trades I would look to sell from around 16.656 to our all time low at 15.056. If the price decides to extend its rally then I would be looking to sell between the prices 18.175 and 16.705. On the other side of the silver coin we could look to go long when our indicators start shedding light on a potential reversal that I don't see coming until early 2015 and at the earliest late into December of this year.

SILVER (XAGUSD):

Since its inception into the FOREX markets the precious metal has been down-trending against the USD. Our daily chart shows us that we have a few good opportunities for short term trades while looking to the long term horizon for buying low...lower than its price has EVER been.

For some immediate trades I would look to sell from around 16.656 to our all time low at 15.056. If the price decides to extend its rally then I would be looking to sell between the prices 18.175 and 16.705. On the other side of the silver coin we could look to go long when our indicators start shedding light on a potential reversal that I don't see coming until early 2015 and at the earliest late into December of this year.

For some immediate trades I would look to sell from around 16.656 to our all time low at 15.056. If the price decides to extend its rally then I would be looking to sell between the prices 18.175 and 16.705. On the other side of the silver coin we could look to go long when our indicators start shedding light on a potential reversal that I don't see coming until early 2015 and at the earliest late into December of this year.

Telling a bit of a more interesting story to traders and investors alike. A similar downtrend has carried the pair to all time lows breaking a long term support price around 1179.72. Although the price has since surfaced above closed on top of this price that doesn't mean the pair is in reversal mode just yet. A move to close above the support tells us that we have a support price to look to for a buy.

From the 1179.72 support we could see the price elevate to 1241.39 which is basically the next immediate resistance level. Upon closer examination of a 240min chart we can see the market beginning to form a bit of a support trend line for the price to follow. The chart also reveals a nice area to take profits and consider a reversal trade. From the support aforementioned to the next actual resistance at 1230.68 is an initial buy idea. If the resistance is broken I would want to see the next major resistance broken at 1241.39 which is only a little less than $11 away from the initial profit target. If the second resistance is broken then I would anticipate the downward trend-line being broken to test the dashed resistance trend-line. From there a play at the 2014 highs may be in order.

Forex Markets Fluctuate With S&P, Dow Average at Record

The end of the year is approaching and this is a great time to start looking for good investments that will carry you through the beginning of next year. The early bird gets the word and remember, all investments require research and analysis along with planning before they can be executed properly. All that takes time and the more time you take the better chances you have of being successful.

Weekly chart shows us that this pair is in a entrancement and currently the price is at some long term resistance at 1.44500. At the same time we were hit with serious divergence on the RSI away from the actual price movement. The market then corrected the price to the current levels.

Looking closer we can see that the chart begins to change formation and trend as we examine EURAUD at closer time frames. On a daily chart we can see that this red resistance line is a pivot for the market and is actually just a volatile range from 1.45300 down to about 1.35500. In 2013 July, August, September, and October were all casualties of this range as well before the price expanded to 2014 highs of around 1.55500. We can also see that the uptrend has flattened out and started trading sideways and our moving averages have tangled and began to flatten pulling our RSI under 50. An even closer look pulls us into the truth of the situation. Our 240min chart shows us that the market has tested this 1.44500 resistance in spectacular fashion creating a beautiful doji candle and also touching its slow moving average after the fast moving average slid under it.

This could be an awesome time to enter short with anticipation of seeing the price come back below 1.40000 with a profit target of 1.30000. That trade could last you a month or two. Trades like this provide steady consistent gains steady consistent gains and a healthy profits.

GBPUSD:

This pair is in a very tight range and currently below its slow moving average. But that doesn't help us much because our slow moving average is below our fast moving average, so technically this pair is supposed to be on an up trend.

This could be an awesome time to enter short with anticipation of seeing the price come back below 1.40000 with a profit target of 1.30000. That trade could last you a month or two. Trades like this provide steady consistent gains steady consistent gains and a healthy profits.

GBPUSD:

This pair is in a very tight range and currently below its slow moving average. But that doesn't help us much because our slow moving average is below our fast moving average, so technically this pair is supposed to be on an up trend.

The good news is that the is that the pair is on an uptrend. Just a technically unfriendly looking uptrend. From 2009 the pair has made higher lows and higher highs but in the harshest ranges and volatile formations. The highest highs in 5 years came in July of this year, but since then the price has taken a steady tumble towards its current levels where it has began gyrating between 1.61542 and 1.59773.

In situations like this I rely on my candlestick skills to guide me through the times when price action and pattern formations are null & void. What I can see from the daily chart is that the support and resistance is strong on both sides but the middle of the ranges are quiet or they get completely skipped over. That tells me this is being orchestrated.

The good news is that the is that the pair is on an uptrend. Just a technically unfriendly looking uptrend. From 2009 the pair has made higher lows and higher highs but in the harshest ranges and volatile formations. The highest highs in 5 years came in July of this year, but since then the price has taken a steady tumble towards its current levels where it has began gyrating between 1.61542 and 1.59773.

In situations like this I rely on my candlestick skills to guide me through the times when price action and pattern formations are null & void. What I can see from the daily chart is that the support and resistance is strong on both sides but the middle of the ranges are quiet or they get completely skipped over. That tells me this is being orchestrated. From our 240min chart I can see that this pair met divergence from its price and RSI between the days of 10/3 and 10/15. The long green candles followed by the moderate sized bear candles tell me that more Pounds are being bought than dollars begin sold. Even though the resistance is strong it isn't as strong as the support or dramatic. We see the bullish rallies executed with conviction while the shorts come in spurts in between low volume.

I see the market makers building positions long GBP to offset these past few weeks of ranging. From 1.59773 for a move to 1.65000 would be my initial target with profit target to 1.70000. My confirmation would be the market carrying the price over 1.61542 range highs.

From our 240min chart I can see that this pair met divergence from its price and RSI between the days of 10/3 and 10/15. The long green candles followed by the moderate sized bear candles tell me that more Pounds are being bought than dollars begin sold. Even though the resistance is strong it isn't as strong as the support or dramatic. We see the bullish rallies executed with conviction while the shorts come in spurts in between low volume.

I see the market makers building positions long GBP to offset these past few weeks of ranging. From 1.59773 for a move to 1.65000 would be my initial target with profit target to 1.70000. My confirmation would be the market carrying the price over 1.61542 range highs.

Looking closer we can see that the chart begins to change formation and trend as we examine EURAUD at closer time frames. On a daily chart we can see that this red resistance line is a pivot for the market and is actually just a volatile range from 1.45300 down to about 1.35500. In 2013 July, August, September, and October were all casualties of this range as well before the price expanded to 2014 highs of around 1.55500. We can also see that the uptrend has flattened out and started trading sideways and our moving averages have tangled and began to flatten pulling our RSI under 50. An even closer look pulls us into the truth of the situation. Our 240min chart shows us that the market has tested this 1.44500 resistance in spectacular fashion creating a beautiful doji candle and also touching its slow moving average after the fast moving average slid under it.

This could be an awesome time to enter short with anticipation of seeing the price come back below 1.40000 with a profit target of 1.30000. That trade could last you a month or two. Trades like this provide steady consistent gains steady consistent gains and a healthy profits.

This could be an awesome time to enter short with anticipation of seeing the price come back below 1.40000 with a profit target of 1.30000. That trade could last you a month or two. Trades like this provide steady consistent gains steady consistent gains and a healthy profits. The good news is that the is that the pair is on an uptrend. Just a technically unfriendly looking uptrend. From 2009 the pair has made higher lows and higher highs but in the harshest ranges and volatile formations. The highest highs in 5 years came in July of this year, but since then the price has taken a steady tumble towards its current levels where it has began gyrating between 1.61542 and 1.59773.

The good news is that the is that the pair is on an uptrend. Just a technically unfriendly looking uptrend. From 2009 the pair has made higher lows and higher highs but in the harshest ranges and volatile formations. The highest highs in 5 years came in July of this year, but since then the price has taken a steady tumble towards its current levels where it has began gyrating between 1.61542 and 1.59773.

In situations like this I rely on my candlestick skills to guide me through the times when price action and pattern formations are null & void. What I can see from the daily chart is that the support and resistance is strong on both sides but the middle of the ranges are quiet or they get completely skipped over. That tells me this is being orchestrated. From our 240min chart I can see that this pair met divergence from its price and RSI between the days of 10/3 and 10/15. The long green candles followed by the moderate sized bear candles tell me that more Pounds are being bought than dollars begin sold. Even though the resistance is strong it isn't as strong as the support or dramatic. We see the bullish rallies executed with conviction while the shorts come in spurts in between low volume.

From our 240min chart I can see that this pair met divergence from its price and RSI between the days of 10/3 and 10/15. The long green candles followed by the moderate sized bear candles tell me that more Pounds are being bought than dollars begin sold. Even though the resistance is strong it isn't as strong as the support or dramatic. We see the bullish rallies executed with conviction while the shorts come in spurts in between low volume.

From our 240min chart I can see that this pair met divergence from its price and RSI between the days of 10/3 and 10/15. The long green candles followed by the moderate sized bear candles tell me that more Pounds are being bought than dollars begin sold. Even though the resistance is strong it isn't as strong as the support or dramatic. We see the bullish rallies executed with conviction while the shorts come in spurts in between low volume.

From our 240min chart I can see that this pair met divergence from its price and RSI between the days of 10/3 and 10/15. The long green candles followed by the moderate sized bear candles tell me that more Pounds are being bought than dollars begin sold. Even though the resistance is strong it isn't as strong as the support or dramatic. We see the bullish rallies executed with conviction while the shorts come in spurts in between low volume.

I see the market makers building positions long GBP to offset these past few weeks of ranging. From 1.59773 for a move to 1.65000 would be my initial target with profit target to 1.70000. My confirmation would be the market carrying the price over 1.61542 range highs.

E-Commerce In China

Recently a follower of mine on Twitter asked me to research a company with the ISO symbol of DANG. Here is a brief analysis of this stock.

E-Commerce China DangDang Inc. (DANG):

A company whose business is business to customer, B2C, e-commerce. They sell books, other media, and selected general merchandise. An initial look at the stock's daily chart shows us that the market carried the price to 2014 highs around 19.50. From there it sold off heavily until rebounding off of what looks like support from a trend line reaching back to April 2013. The market tried to reach for highs in July but failed to make higher highs and created a resistance trend line. That coupled with the opposite trend line formed a wedge on the chart.

Upon closer examination we can see what the market is truly doing with this stock. We can see on the 60min chart below that the market is carrying this pair higher after nearly 2 months of selling. most recently 11.74 has acted as decent support but our resistance is yet to be discovered. The most immediate price that might contain the rally is 13.68 which provides short sellers a good entry. For The bulls another opportunity to buy this stock has not presented itself yet. The 11.74 support would have been ideal to enter at.

Upon closer examination we can see what the market is truly doing with this stock. We can see on the 60min chart below that the market is carrying this pair higher after nearly 2 months of selling. most recently 11.74 has acted as decent support but our resistance is yet to be discovered. The most immediate price that might contain the rally is 13.68 which provides short sellers a good entry. For The bulls another opportunity to buy this stock has not presented itself yet. The 11.74 support would have been ideal to enter at.

I see this stock moving higher into the next resistance level at 14.85 where we see it meet the resistance trend line. Once the stock has found another support I would look to buy the stock with a target at 14.85. After that target is hit I'd be looking for a short from that level if and only if the downward trend line and resistance level are rejected. If the market decides to rally past the resistance I would take 50% of my profits re-set my S/L and watch the market carry the trade off into the sunset.

I see this stock moving higher into the next resistance level at 14.85 where we see it meet the resistance trend line. Once the stock has found another support I would look to buy the stock with a target at 14.85. After that target is hit I'd be looking for a short from that level if and only if the downward trend line and resistance level are rejected. If the market decides to rally past the resistance I would take 50% of my profits re-set my S/L and watch the market carry the trade off into the sunset.

E-Commerce China DangDang Inc. (DANG):

A company whose business is business to customer, B2C, e-commerce. They sell books, other media, and selected general merchandise. An initial look at the stock's daily chart shows us that the market carried the price to 2014 highs around 19.50. From there it sold off heavily until rebounding off of what looks like support from a trend line reaching back to April 2013. The market tried to reach for highs in July but failed to make higher highs and created a resistance trend line. That coupled with the opposite trend line formed a wedge on the chart.

Upon closer examination we can see what the market is truly doing with this stock. We can see on the 60min chart below that the market is carrying this pair higher after nearly 2 months of selling. most recently 11.74 has acted as decent support but our resistance is yet to be discovered. The most immediate price that might contain the rally is 13.68 which provides short sellers a good entry. For The bulls another opportunity to buy this stock has not presented itself yet. The 11.74 support would have been ideal to enter at.

Upon closer examination we can see what the market is truly doing with this stock. We can see on the 60min chart below that the market is carrying this pair higher after nearly 2 months of selling. most recently 11.74 has acted as decent support but our resistance is yet to be discovered. The most immediate price that might contain the rally is 13.68 which provides short sellers a good entry. For The bulls another opportunity to buy this stock has not presented itself yet. The 11.74 support would have been ideal to enter at.  I see this stock moving higher into the next resistance level at 14.85 where we see it meet the resistance trend line. Once the stock has found another support I would look to buy the stock with a target at 14.85. After that target is hit I'd be looking for a short from that level if and only if the downward trend line and resistance level are rejected. If the market decides to rally past the resistance I would take 50% of my profits re-set my S/L and watch the market carry the trade off into the sunset.

I see this stock moving higher into the next resistance level at 14.85 where we see it meet the resistance trend line. Once the stock has found another support I would look to buy the stock with a target at 14.85. After that target is hit I'd be looking for a short from that level if and only if the downward trend line and resistance level are rejected. If the market decides to rally past the resistance I would take 50% of my profits re-set my S/L and watch the market carry the trade off into the sunset. 3 Hot Penny Stocks For Anybody

Penny stocks are starting to heat up as many major companies gain steam and look to upgrade their status on the exchanges. Without getting into a fundamental vs technical analysis debate I want to show a few stocks that look like good trades that can fit anyone's portfolio size and risk appetite.

Primco Management, Inc. (PMCM):

I wrote a post not too long ago about this company and their diverse portfolio of business that this company manages. Although they have some interesting deals pending that doesn't help share holders make money today. That is shown in the stocks charts. A downward spiral that started in July of this year lead this stock to its all time lows where it now resides. We can see on a 240min chart that the stock has been ranging since October between 0.0001 and 0.0004.

Primco Management, Inc. (PMCM):

I wrote a post not too long ago about this company and their diverse portfolio of business that this company manages. Although they have some interesting deals pending that doesn't help share holders make money today. That is shown in the stocks charts. A downward spiral that started in July of this year lead this stock to its all time lows where it now resides. We can see on a 240min chart that the stock has been ranging since October between 0.0001 and 0.0004.

My first idea for this stock is to sell from 0.0004 down to 0.0001 if you can; or from 0.0001 until it crashes. If this stock is going to make any recovery I see it being capped at 0.0013; another, better, selling opportunity.

Gone baby gone. A long downtrend has carried the stock to its lowest prices in history. 0.0016 is the major support that was broken and now will be looked to for resistance in the future if this stock decides to move higher. An interesting pattern has emerged on the 15min chart; we see that 9/30/14 was the start of a 9 day swing lower from 0.0010 to 0.0006 (10/09/14). Just 19 days later the price swung from (10/28/14) 0.0006 to 0.0002 (11/17/14) another -0.0004 drop. At this point I'm thinking between another 29 to 38 days will provide us with the truth about this pattern.

The pattern coupled with the lack of support tells me their might be a clear drop to crash this stock. A sell from 0.0002 would be good to see the stock fall to 0.0001 or even 0.0000 lol. If the market decides to move higher then a sell from 0.0006 or 0.0010 are better prices to sell from.

A bit of a market lottery. This stock has been on a falling trend since maybe 2008. More recently we have experienced a nice gap lower and the market decided to quickly turn around and fill that gap. Immediately this gives me the template for a perfect breakout or breakdown trade. I can either buy this trade right out of 2.5457 towards 3.25 then 4.00. On the other side of the scenario we could sell the stock from 1.9855 down to its recent support at 1.4300.

Best Trades Of November

In the fourth quarter of the year November might be one of the best trading months. As banks and corporations try to finish the year strong while also not risking enough to ruin their year of hard work. I've chosen a few stocks for you all to consider so you can do the same. Most of these stocks are in a position which I feel are prime opportunities to invest in some considerably discounted priced companies and to have positions that will generate sizable gains while reducing the risks of extreme volatility.

The restaurant's share price gaped up last week and created a nearly $9.00 price difference. With addition to its strong uptick the stock also managed to settle its price above a previous resistance level turning it into support. I know two things. This gap will have to be filled and Traders want both a new high and they want it soon.

I see this stock holding this support at $149.57, maybe testing the $145.06 gap range high. Buy the support. and $145.06. If $145.06 is broken and closed below I'd close my position and try again at the bottom of the range at $136.53. From here I'd Be looking for a profit target of $167.97.

I see this stock holding this support at $149.57, maybe testing the $145.06 gap range high. Buy the support. and $145.06. If $145.06 is broken and closed below I'd close my position and try again at the bottom of the range at $136.53. From here I'd Be looking for a profit target of $167.97.

The game software and content creator is in one of the most exciting positions of almost all on the market in my opinion. On a weekly chart we can see the stock testing its most pivotal resistance level since 2008.

We can see a beautiful green dashed trendline of support which the market seems to love. As beautiful as it seems we all must remember that because of its beauty it exists and because it exists it has to be tested by those who care. Just as the stocks price is testing its extremes to the upside, it must also test its supporters moving itself to the downside.

We can see a beautiful green dashed trendline of support which the market seems to love. As beautiful as it seems we all must remember that because of its beauty it exists and because it exists it has to be tested by those who care. Just as the stocks price is testing its extremes to the upside, it must also test its supporters moving itself to the downside.  From this daily chart we can see that the high of the range the market created last week is also the previous highest high since 2008. The pivotal resistance being tested is $41.08. From this high I'd look to fade this trend only to previous resistance for a support test at $38.73. If it holds I would reverse my position. If it breaks I'd look to buy around $35.00 from there I'd look for the trendline to support the price back up towards the high of $41.08 and above.

From this daily chart we can see that the high of the range the market created last week is also the previous highest high since 2008. The pivotal resistance being tested is $41.08. From this high I'd look to fade this trend only to previous resistance for a support test at $38.73. If it holds I would reverse my position. If it breaks I'd look to buy around $35.00 from there I'd look for the trendline to support the price back up towards the high of $41.08 and above.

With a downside resistance trend line broken, and a recent resistance price taken over as support we can see a similarity between all of the patterns and indicators. The market has created a gap at $70.92 to $76.41 about $5.49/share worth of equity left in the market.

Most immediately I see the price moving towards the most recent highest high from mid-October at $84.83. A buy from new support at $76.41 up to $84.83 would be my first instinct as a good trader; gaining nearly $8.42/share. If the resistance is strong and the price is rejected I would look to short from there with plans on recovering all of the equity from the support of $70.92, around $13.91/share. on the way down.

Most immediately I see the price moving towards the most recent highest high from mid-October at $84.83. A buy from new support at $76.41 up to $84.83 would be my first instinct as a good trader; gaining nearly $8.42/share. If the resistance is strong and the price is rejected I would look to short from there with plans on recovering all of the equity from the support of $70.92, around $13.91/share. on the way down.

Gaping up on Friday scared the hell out of the short sellers and made the smart traders laugh. This stock has created another gap that has to be filled between $202.50 and $215.18 about $12.68/share. For this stock I would do the same set-up as in GPRO. Buy into resistance $236.95 and sell into 1st support $215.18 and hope for a break to fill the gap and touch 2nd support at $202.50. If that happens reverse the trade at 2nd support.

This stock has gaped up and closed above resistance $18.09 to turn it into support. I drew a few trend lines that spell out a wave pattern in my eyes. from 1 to 2 we see an uptrend begin. from 2 to 3 we see a downtrend that rested and was supported around $13.95 and 3 to 4 is where we are at this point. I see the market carrying the price from $18.09 to $20.88 this month.

Currency Recap

This is a brief recap of some trades that have been open, closed, or watched. I will reference the original post about these currency pairs by linking their names to the articles. Click them to see where we began on our journey with these pairs and where we originally targeted as our exits.

This pair is giving short sellers some trouble. It has broken through many intra-day resistance levels, against its near term trend to stretch towards the MA and last resistance available at 87.20. We should be happy about seeing the slow moving average cross over the fast moving average. From here we will close our short positions if this slow purple moving average line is closed above 2 days in a row and 87.20 resistance is broken. On the contrary, if this resistance is held we can buy more JPY and improve our Dollar Cost Average on the trade. 82.10 is still our first profit target and 80.25 is still our complete target and exit price. Remember that this position is our hedge to the JPY selling going on across the rest of the major currencies.

Still the favorite buy for this year. The strategy on this trade was to catch every major swing, up and down. We managed to enter the market with a buy for 500k units from 104.900 and held until 110.000 where we took profit on 250k. We bought 5,000,000 more around 107.000 and held those until 112.000 where we took profit and sold 1,750,000. We took profit on a total of 2,000,000 units or 20 lots. Expecting to see this pair reach 115.000. That's nearly 510 pips gained on 250k units, 500 pips on 1,500,000 units, and 710 pips on 250k units. Follow the ABCD path.

Same story on this pair with a bit more significance behind the most recent up-swing. Where the USD and EUR have acted similar against JPY we must note that the European region suffers a bit more with controlling their economic levels. This recent swing pulls this pair out of a longer standing and better sustained uptrend than its counterpart USDJPY was in. This pair still shows signs of risking its gains for another run towards the downside as we see a resistance trend line capping the most recent rally.

For this trade our average price was 136.000 and we carried this pair to the resistance trenline aforementioned at around 140.000.

For this trade our average price was 136.000 and we carried this pair to the resistance trenline aforementioned at around 140.000.  If the market can't move the price past the recent swing high around 141.250 then we can expect to see a pull back towards the most relevant support level at 137.938. We had 3,000,000 units or 30 lots on this pair and we sold at 140.000 from 136.000. That's approximately 400 pips profit.

If the market can't move the price past the recent swing high around 141.250 then we can expect to see a pull back towards the most relevant support level at 137.938. We had 3,000,000 units or 30 lots on this pair and we sold at 140.000 from 136.000. That's approximately 400 pips profit.

Buy Weed (Recap)

Last month I had a chance to go over 3 companies whose businesses reside in the newly emerging Marijuana Industry. This is a recap of what the stocks have been doing since we did our first bit of research and analysis on them. If you're unfamiliar with the previous analysis be sure to read the first post about these stocks.MCIG:

Our first look at this stock revealed its test of a pivotal price of .2604 and at the time of the analysis there wasn't much to say or do with the stock because of the risks associated with both sides of trading this company.

After being patient we see that the stock decided to break that .2604 support level and send the price near its next support level around .1500. After the support was broken we saw the market try to retake that price but ended up turning it into resistance.

After being patient we see that the stock decided to break that .2604 support level and send the price near its next support level around .1500. After the support was broken we saw the market try to retake that price but ended up turning it into resistance.

If this stock has a chance to break out of this volatile range I would look to buy it from once resistance and support .2604. If this stock decides to continue lower I would Look to short it from that same .2604 down to .1500.

If this stock decides to continue lower I would Look to short it from that same .2604 down to .1500.

If this stock decides to continue lower I would Look to short it from that same .2604 down to .1500.

If this stock decides to continue lower I would Look to short it from that same .2604 down to .1500.

MDBX:

This stock has a very interesting pattern it's been repeating since its IPO which simply looks like heavy support around 8.1100 and strong resistance around 80.000.

From the support we saw the bulls step in and buy this stock up over 50% to around $15/share. This recent buying spree has also carried the stocks RSI indicator above the 50 level. Highlighted in blue we can see the move up & away from the support level.

This recent buying spree has also carried the stocks RSI indicator above the 50 level. Highlighted in blue we can see the move up & away from the support level.

This recent buying spree has also carried the stocks RSI indicator above the 50 level. Highlighted in blue we can see the move up & away from the support level.

This recent buying spree has also carried the stocks RSI indicator above the 50 level. Highlighted in blue we can see the move up & away from the support level.  On this 60min chart we can see that the pair is in an uptrend and has just recently retraced to test the 12.050 support price while also being carried by the recent support trend-line. I'd be looking for entries to the long side to confirm my theories on the bounce from support to the swing highs around $40 and next $80. For the risky traders, try a sell from $13.000 and if it breaks 12.050 you may be on to something big.

On this 60min chart we can see that the pair is in an uptrend and has just recently retraced to test the 12.050 support price while also being carried by the recent support trend-line. I'd be looking for entries to the long side to confirm my theories on the bounce from support to the swing highs around $40 and next $80. For the risky traders, try a sell from $13.000 and if it breaks 12.050 you may be on to something big.

This stock was in a beautiful uptrend when we first came across it. At the time of the analysis the stock was moving into a bit of consolidation trading and we saw the daily ranges decrease and the volatility increase.

Most recently this stock has tested extreme lows around $5.000 and at one point $3/share. This looked like a 52-fake-out because a rally came soon after and the market found support for the stock around 6.0066.

Most recently this stock has tested extreme lows around $5.000 and at one point $3/share. This looked like a 52-fake-out because a rally came soon after and the market found support for the stock around 6.0066.

The blue highlighted area is the range the stock traded in before it finally tilted over and dumped the price lower. We can also see the price supported by a green dashed support trend line; now the RSI is below 50.

We can also see the price supported by a green dashed support trend line; now the RSI is below 50.

We can also see the price supported by a green dashed support trend line; now the RSI is below 50.

We can also see the price supported by a green dashed support trend line; now the RSI is below 50.

A 60min chart gives us the chance to see the highlighted range along with a closer look at the beginning of the downtrend we are in.  We can clearly see the price respecting a resistance trend line. If the market keeps the daily closes 6.2000 I see a further extension of this downtrend. I would be patient with my entry on this stock. I want to see the 6.0066 support broken and I'll use that as my sell entry.

We can clearly see the price respecting a resistance trend line. If the market keeps the daily closes 6.2000 I see a further extension of this downtrend. I would be patient with my entry on this stock. I want to see the 6.0066 support broken and I'll use that as my sell entry.

We can clearly see the price respecting a resistance trend line. If the market keeps the daily closes 6.2000 I see a further extension of this downtrend. I would be patient with my entry on this stock. I want to see the 6.0066 support broken and I'll use that as my sell entry.

We can clearly see the price respecting a resistance trend line. If the market keeps the daily closes 6.2000 I see a further extension of this downtrend. I would be patient with my entry on this stock. I want to see the 6.0066 support broken and I'll use that as my sell entry. Halloween's Hottest Trending Stocks

There was a lot of freaky trading action going across the markets today. I want to first of all thank the Bank Of Japan for such a market friendly economic forecast. I won't get in to my currency investments and trades just yet; Right now I want to focus on the U.S. Equity Markets which have been so kind to us good traders and investors today.

Aegerion Pharmaceuticals Inc. (AEGR):

This stock has been on a slippery slope since this time of the year in 2013. The downtrend resistance has been violated but the market responded with a 7 month range. We are now seeing the market send the stock's price out of the range and much lower breaking though a major resistance from April of 2011 being tested as support. The next support level to watch is the 17.94 price.

Upon closer examination we can see that the market has actually gaped lower for the second time and the first gap was the beginning of the range. This signals me to start wondering if this is an exhaustion gap or a continuation/breakaway gap. Only a successful test of the next support and a strong bounce to fill the 2 previous gaps will tell us the answer. Below we can see where a seller should be cautious. Major support is near and there are two gaps that need to be filled and today tells us those gaps can be filled in a day's trading range.

Upon closer examination we can see that the market has actually gaped lower for the second time and the first gap was the beginning of the range. This signals me to start wondering if this is an exhaustion gap or a continuation/breakaway gap. Only a successful test of the next support and a strong bounce to fill the 2 previous gaps will tell us the answer. Below we can see where a seller should be cautious. Major support is near and there are two gaps that need to be filled and today tells us those gaps can be filled in a day's trading range.

Starbucks (SBUX):

Giving retail traders hell obviously. This stock has created a host of trade-able patterns and signals Bouncing off of a long term support line and over a mid-term resistance trendline, this pair has taken an interesting route over the past 9 months.

As of now the stock is in a steep uptrend and creating a shorter term up trend that is a lot less vertical which gives me a better feeling.

MercadoLibre, Inc. (MELI):

November 2013 gaped lower and continued lower through 2014 until June where it began a solid uptrend that included a gap itself. Recently the market has favored this stock bouncing it off trendline support and when it got to resistance it gaped again! This gap was special because this time around the market took the price right over the entire 2013 gap. From resistance at 116.21 to today's low of 130.93 and even made higher 7 month highs to over 140.00. Yearly highs are 146.11 and either the market will blast through this resistance or reject the price and send the stock lower towards the gaps highlighted in blue.

If this is the case I see the market filling the gap and the best zone to buy from would be between the 116.21 and 119.13 area. And I'm probably right.

If this is the case I see the market filling the gap and the best zone to buy from would be between the 116.21 and 119.13 area. And I'm probably right.

Aegerion Pharmaceuticals Inc. (AEGR):

This stock has been on a slippery slope since this time of the year in 2013. The downtrend resistance has been violated but the market responded with a 7 month range. We are now seeing the market send the stock's price out of the range and much lower breaking though a major resistance from April of 2011 being tested as support. The next support level to watch is the 17.94 price.

Upon closer examination we can see that the market has actually gaped lower for the second time and the first gap was the beginning of the range. This signals me to start wondering if this is an exhaustion gap or a continuation/breakaway gap. Only a successful test of the next support and a strong bounce to fill the 2 previous gaps will tell us the answer. Below we can see where a seller should be cautious. Major support is near and there are two gaps that need to be filled and today tells us those gaps can be filled in a day's trading range.

Upon closer examination we can see that the market has actually gaped lower for the second time and the first gap was the beginning of the range. This signals me to start wondering if this is an exhaustion gap or a continuation/breakaway gap. Only a successful test of the next support and a strong bounce to fill the 2 previous gaps will tell us the answer. Below we can see where a seller should be cautious. Major support is near and there are two gaps that need to be filled and today tells us those gaps can be filled in a day's trading range.

Giving retail traders hell obviously. This stock has created a host of trade-able patterns and signals Bouncing off of a long term support line and over a mid-term resistance trendline, this pair has taken an interesting route over the past 9 months.

As of now the stock is in a steep uptrend and creating a shorter term up trend that is a lot less vertical which gives me a better feeling.

If we take a look at a 240min chart we can see how the stock has gaped below the 75.86 support level and turned it back into resistance today.

There are a lot of conflicting correlations here so I would stay away until the 75.86 price is retaken as support. On the sell side I'd look to sell below 74.00.MercadoLibre, Inc. (MELI):

November 2013 gaped lower and continued lower through 2014 until June where it began a solid uptrend that included a gap itself. Recently the market has favored this stock bouncing it off trendline support and when it got to resistance it gaped again! This gap was special because this time around the market took the price right over the entire 2013 gap. From resistance at 116.21 to today's low of 130.93 and even made higher 7 month highs to over 140.00. Yearly highs are 146.11 and either the market will blast through this resistance or reject the price and send the stock lower towards the gaps highlighted in blue.

If this is the case I see the market filling the gap and the best zone to buy from would be between the 116.21 and 119.13 area. And I'm probably right.

If this is the case I see the market filling the gap and the best zone to buy from would be between the 116.21 and 119.13 area. And I'm probably right.

Cycles, Cycles, Cycles...this stock is all about the cycles. Since 2013 this stock has traded in an interesting cycle which basically is easy to notice. It looks like it's been trading in an uptrend since the beginning of 2013 and carried that trend until March of this year. Around March of this year the market turned the stock around and has been selling it ever since. It appears that on an average of 3 months and on rare occasions 4 months the stock swings in either an up-trend or downtrend. Only in the third cycle did the stock create a vicious triangle which nearly created a whiplash range but was forgiving and gave the bulls a few points.

This trend will either continue lower and break very important resistance at 0.64 during this support test or it will repeat its 2013 trend through 3-4 month buying cycles. A good place to sell from on a near term scale would be 0.86. The green support line should be your target. That's a trade for your account next week. If you really are a braveheart you'll reverse that order once it's completed.

Penny Stock Analysis As Requested

An awesome follower of mine messaged me today and asked me to research about 12 companies. That's a lot of research and analysis so I narrowed the selection down to 3. Here is a brief report on the 3 companies and their near term outlooks.

Monster Arts Inc. (APPZ)

This company started with good intentions but after reading about their half a dozen amendments and multiple stock splits and reverse stock splits, I was completely turned off. In the past 7 years the company has changed their name 4 times and has sold convertible notes to various parties at values as low as $1,000. The board owns the majority of the stock and has gone as far as to dilute the shares offering a staggering 5,000,000,000 at one point. Their chart tells the rest pf the story about why I wouldn't buy this stock in the near future.

We can see here that the stock hasn't been traded enough to even move in price since October of this year. Supposedly the company will be releasing a family locator app as announced here, but I don't think an app is going to save this company. I am neutral on this stock. The fundamentals don't add up and the technicals don't exist. Did I mention the CEO recently made his daughter an executive?

We can see here that the stock hasn't been traded enough to even move in price since October of this year. Supposedly the company will be releasing a family locator app as announced here, but I don't think an app is going to save this company. I am neutral on this stock. The fundamentals don't add up and the technicals don't exist. Did I mention the CEO recently made his daughter an executive?

Monster Arts Inc. (APPZ)

This company started with good intentions but after reading about their half a dozen amendments and multiple stock splits and reverse stock splits, I was completely turned off. In the past 7 years the company has changed their name 4 times and has sold convertible notes to various parties at values as low as $1,000. The board owns the majority of the stock and has gone as far as to dilute the shares offering a staggering 5,000,000,000 at one point. Their chart tells the rest pf the story about why I wouldn't buy this stock in the near future.

We can see here that the stock hasn't been traded enough to even move in price since October of this year. Supposedly the company will be releasing a family locator app as announced here, but I don't think an app is going to save this company. I am neutral on this stock. The fundamentals don't add up and the technicals don't exist. Did I mention the CEO recently made his daughter an executive?

We can see here that the stock hasn't been traded enough to even move in price since October of this year. Supposedly the company will be releasing a family locator app as announced here, but I don't think an app is going to save this company. I am neutral on this stock. The fundamentals don't add up and the technicals don't exist. Did I mention the CEO recently made his daughter an executive?

Announcing a new president October 2nd the company has also released a statement October 13th which details its recent debt reduction initiatives; which also seemed like their way of telling investors that the shares have been diluted at the same time. The company plans to restructure its management team and improve its infrastructure.

The Chart above shows that the company has just broken lower out of a wedged triangle pattern and has resisted its one time support. From a technical perspective this company has little to hold on to and a sell recommendation would fit the lack of fundamental data the company has provided about what it plans to do to build the share price back up. I would recommend selling Frontier Beverage Company.

Let's start with the bad news first: In September of this year the company was caught up in legal issues with pop star Amethyst Kelly aka Iggy Azalea where a subsidiary of Primco, ESMG, released a record that the pop start allegedly never gave permission to release. Primco has denied all and any wrongdoing. No doubt that incident has something to do with the failure of Primco's spin-out of ESMG its music division due to a covenants in its agreements with its creditors.

Now for the good news: Primco was able to complete its acquisition of Suzie Q's which is a Medical Marijuana Collective.

Primco Management is a real-estate management company, multi-media entertainment enterprise and a Medical Marijuana property management firm. The company boasts of residential real-estate development deals in California and Medical Marijuana growing facilities in British Colombia, Canada. That isn't enough to get me passed the fact that they only have 3 employees.

Since the details of all their deals aren't readily available it would be unfair to make a judgement call on the companies strength and the stocks price. The company has a host of partners and after all, does work within the hard asset class of the markets which means they have real equity. This stock presents more opportunities than the aforementioned. When approaching this stock be cautious and keep relevant information near. From a near term technical perspective a recommendation to sell is warranted. Though the price is breaking out of a downtrend and ranging this only says there will be opportunities to sell at better prices than currently. From a fundamental perspective it would be wise to keep in mind the company's pending deals and its ability to liquidate hard assets to free up cash which would of course increase share prices. This stock has a near term sell recommendation with a neutral long term outlook as pending deals and more fundamental news is necessary to support such a companies stock.

Market Grade Recap

Grading The Markets

This is a scoring method which determines the grade on the major currency pairs and U.S. Equity Indices. The score card will tell us which instruments have moved the most, negatively or positively, since the market has opened. For currencies the grades are determined by factoring the gains or losses between each major currency vs its counterparts. U.S. Equity Indices receive their grade based on their change from the week's ending quotes vs this weeks opening quotes. News and Announcements are not taken into consideration.

USD:

EURUSD- LOST -0.17%

GBPUSD- LOST -0.34%

USDCHF- LOST -0.20%

USDCAD- WON +0.08% Grade: 14% Closed Up 14% From Week Open

USDJPY- LOST -0.11%

AUDUSD- LOST -0.39%

NZDUSD- LOST -0.40%

EURUSD- WON +0.17%

EURGBP- LOST -0.16%

EURCHF- LOST -0.03%

EURCAD- WON +0.25% Grade: 43% Closed Flat From Week Open

EURJPY- WON +0.06%

EURAUD- LOST -0.22%

EURNZD- LOST -0.24%

GBPUSD- WON +0.34%

EURGBP- WON +0.16%

GBPCHF- WON +0.14%

GBPCAD- WON +0.41% Grade: 71% Closed Flat From Week Open

GBPJPY- WON +0.23%

GBPAUD- LOST -0.06%

GBPNZD- LOST -0.08%

A grade below 50% would be a signal that the currency is being sold more than bought across the markets. A grade above 50% is a sign that the opposite is happening and that currency would be one worth considering buying across the market. Clicking the currency you'd like to know more about will -redirect you to that symbols index information.

DJIA: WON +0.76%

S&P 500: WON +0.71%

NYSE COMPOSITE: WON +0.61%

NASDAQ: WON +0.69%

This is a scoring method which determines the grade on the major currency pairs and U.S. Equity Indices. The score card will tell us which instruments have moved the most, negatively or positively, since the market has opened. For currencies the grades are determined by factoring the gains or losses between each major currency vs its counterparts. U.S. Equity Indices receive their grade based on their change from the week's ending quotes vs this weeks opening quotes. News and Announcements are not taken into consideration.

USD:

EURUSD- LOST -0.17%

GBPUSD- LOST -0.34%

USDCHF- LOST -0.20%

USDCAD- WON +0.08% Grade: 14% Closed Up 14% From Week Open

USDJPY- LOST -0.11%

AUDUSD- LOST -0.39%

NZDUSD- LOST -0.40%

EURUSD- WON +0.17%

EURGBP- LOST -0.16%

EURCHF- LOST -0.03%

EURCAD- WON +0.25% Grade: 43% Closed Flat From Week Open

EURJPY- WON +0.06%

EURAUD- LOST -0.22%

EURNZD- LOST -0.24%

GBPUSD- WON +0.34%

EURGBP- WON +0.16%

GBPCHF- WON +0.14%

GBPCAD- WON +0.41% Grade: 71% Closed Flat From Week Open

GBPJPY- WON +0.23%

GBPAUD- LOST -0.06%

GBPNZD- LOST -0.08%

A grade below 50% would be a signal that the currency is being sold more than bought across the markets. A grade above 50% is a sign that the opposite is happening and that currency would be one worth considering buying across the market. Clicking the currency you'd like to know more about will -redirect you to that symbols index information.

DJIA: WON +0.76%

S&P 500: WON +0.71%

NYSE COMPOSITE: WON +0.61%

NASDAQ: WON +0.69%

A Little Options Lesson From A Friend

I have the pleasure of working with some awesome traders and when you have friends who are great traders you get the chance to learn all sorts of new trading tricks. I recently had my friend Jennifer (Twitter: @Whiskeywoman a #GirlsWhoTrade member) explain one of her favorite options strategies and I want to share it with you all.

Here's her explanation of the Iron Condor Option Strategy:

Here's her explanation of the Iron Condor Option Strategy:

One of my favorite go-to strategies is the Iron Condor (IC). It is a defined risk option trade that involves two vertical spreads. The best stock to use this strategy on is one that is in a neutral position. I have been putting ICs on the SPX since Jan 2014. It is my most profitable trade by far this year. I usually have 3-4 ICs on at once. I am not looking to swing to the fences with this type of trade. It has been a slow steady source of income to supplement my CL scalping addiction.

The first thing I look for in a new trade is time. I like to go out about 45 days. I usually set up the trade for Monday morning. It may take a couple of days to fill, but I am patient.

The first thing I look for in a new trade is time. I like to go out about 45 days. I usually set up the trade for Monday morning. It may take a couple of days to fill, but I am patient.

Next thing I look for is the 95% probability OTM put. Once I have found it in my option chain, I check open interests. It is usually pretty thin, so I have been getting braver and moving up to 93% or 92% probability. I put on the put side at 20 wide. After that I do the same thing on the call side. This will generate a credit.

Example: I have Dec.1 2050/2070 on the call side (sell the 2050 & buy the 2070) and the 1700/1680 put side (sell the 1700 & buy the 1680).

What I am hoping happens is that SPX will stay under my short call and above my short put. Somewhere in between 2050 and 1700 is perfect.

I have put on 25 SPX ICs in the last 10 months and have zero losers. I attribute that to the length of time I give myself to be profitable and also to letting the trade work itself out. The other thing I don’t do is “manage” the trade. I put the trade on knowing max loss and being okay with that should it happen. I don’t usually let my ICs expire worthless. I am looking for a minimum of 50% profit. I usually take 75%+.

I know I mentioned that the best stock to use this strategy on is one that is in a neutral position and the SPX has been bullish overall. The SPX has enough movement and volatility to make this work for me.

My put sides were tested during this last pull-back, but I held on and closed 3 of them out yesterday for 87% profit, 62% profit, and 66% profit.

Q4 $1Million Market Picks

The markets have been good this year. The 4th quarter is upon us and here are my picks for investments. Across 4 markets I've chosen 1 instrument per market that I believe show signs of promising gains to close out the year. The instruments and strategies are organized from easiest to trade to hardest to trade.

This pair has been a terror for most retail traders, probably because of the volatility. Asian and Australian pairs have been notorious for their relentless daily whip-lashing. Recently the pair has shown signs of its true intentions. It has been rejected at 85.500 and I see it finally giving us the sell of we've been waiting for. A sell at intra-day resistance 84.700 would be an ideal entry for a trader who's ready to see the pair fall past its recent support (83.945) down to its next support area and 50% Fibonacci level 82.100. I don't see much history for this price so I see traders breaking this support and carrying the pair down with support in the range between 81.000 and 80.000 which can be used at profit targets.

The precious metal has seen its share of being chased by bears. They did a good job of reducing the price over 15% from the highs of the year around 1390.00. I see the chart telling me their time has come to an end but we must be careful with the way we handle this instrument. It's for the big boys so we have to be big boys to handle the price swings. Recently the price has risen above some resistance and I see it continuing. 1240.00 was the resistance and now I want to see it act as support. If this support isn't held I see traders testing 1220.00 as support. From the support I see the price rising to 1280.00 which is the next resistance level to test. If this resistance isn't sustained I see traders taking the price up to the last resistance 1328.00; which brings us into breakout territory but I would close my entire position before I dip in for more.

IBM:

Has recently gaped lower and at a pretty interesting place on its chart. Interestingly enough this stock has dropped from its 23.6% Fibonacci level ($182.03) to below $168.10 and continued lower. From here I see the stock either moving higher to test 168.10 for a resistance test to continue lower towards $147.74. If traders don't support that price I see it falling further to $131.23 which so happens to be right above the 61.8% Fibonacci level; I'd call that confluence. From here I'd look for a buy to see the stock return to its uptrend and back towards $200. Between $168.10 and $182.03 we'll probably see some ranging and congestion as the gap gets filled and all the prices in between are hit.

Upon further examination on our 60min chart we can see more details. A resistance test at $6331.24 is our sell entry near our red resistance line and that should carry us down to the $6236.95 level and if that level is held we should close our sell and enter long here; but if the support is broken we should only close half of our sell order and continue the ride down to $6149.82, our next support level. This price is also our most ideal entry to buy. From this dip we should see the price supported and rise to $6236.95 then continue to try to make a breakout move again above $6331.24. So yes, I'm asking you to sell this index right down tho the prices we are going to buy from.

Upon further examination on our 60min chart we can see more details. A resistance test at $6331.24 is our sell entry near our red resistance line and that should carry us down to the $6236.95 level and if that level is held we should close our sell and enter long here; but if the support is broken we should only close half of our sell order and continue the ride down to $6149.82, our next support level. This price is also our most ideal entry to buy. From this dip we should see the price supported and rise to $6236.95 then continue to try to make a breakout move again above $6331.24. So yes, I'm asking you to sell this index right down tho the prices we are going to buy from.

LAST BUT NOT LEAST...

DWCTOB: (Dow Jones Wilshire Tobacco Index)

We can see the markets are a bit confused from the crossing of the slow and fast moving averages (as discussed in an earlier post) circled in white. The index has just posted a shooting star candle that so happens to show some bearish divergence on its RSI. Not only do we have signals of weakness but the price peaked just above recent highs $6331.24 from June but failed and couldn't close above the high. I see this instrument falling to near term support at $6236.95 for an immediate sell trade.

Upon further examination on our 60min chart we can see more details. A resistance test at $6331.24 is our sell entry near our red resistance line and that should carry us down to the $6236.95 level and if that level is held we should close our sell and enter long here; but if the support is broken we should only close half of our sell order and continue the ride down to $6149.82, our next support level. This price is also our most ideal entry to buy. From this dip we should see the price supported and rise to $6236.95 then continue to try to make a breakout move again above $6331.24. So yes, I'm asking you to sell this index right down tho the prices we are going to buy from.

Upon further examination on our 60min chart we can see more details. A resistance test at $6331.24 is our sell entry near our red resistance line and that should carry us down to the $6236.95 level and if that level is held we should close our sell and enter long here; but if the support is broken we should only close half of our sell order and continue the ride down to $6149.82, our next support level. This price is also our most ideal entry to buy. From this dip we should see the price supported and rise to $6236.95 then continue to try to make a breakout move again above $6331.24. So yes, I'm asking you to sell this index right down tho the prices we are going to buy from.

YOUR JOB AS TRADER IS NOT TO BE RIGHT ABOUT ANYTHING, IT'S TO MAKE MONEY.

Grading The Markets

This is a score which determines the grade on the major currency pairs and U.S. Equity Indices. The score card will tell us which instruments have moved the most, negatively or positively, since the market has opened. For currencies the grades are determined by factoring the gains or losses between each major currency vs its counterparts. U.S. Equity Indices receive their grade based on their change from last week's ending quotes vs this weeks opening quotes. News and Announcements are not taken into consideration.USD:

EURUSD- LOSING -0.17%

GBPUSD- LOSING -0.28%

USDCHF- LOSING -0.24%

USDCAD- LOSING -0.01% Grade: 0%

USDJPY- LOSING -0.01%

AUDUSD- LOSING -0.35%

NZDUSD- LOSING -0.58%

EUR:

EURUSD- WINNING +0.17%

EURGBP- LOSING -0.09%

EURCHF- LOSING -0.08%

EURCAD- WINNING +0.21% Grade: 43%

EURJPY- WINNING +0.19%

EURAUD- LOSING -0.16%

EURNZD- LOSING -0.30%

GBP:

GBPUSD- WINNING -0.28%

EURGBP- WINNING -0.09%

GBPCHF- WINNING +0.01%

GBPCAD- WINNING +0.32% Grade: 71%

GBPJPY- WINNING +0.29%

GBPAUD- LOSING -0.08%

GBPNZD- LOSING -0.31%

A grade below 50% would be a signal that the currency is being sold more than bought across the markets. A grade above 50% is a sign that the opposite is happening and that currency would be one worth considering buying across the market. Clicking the currency you'd like to know more about will -redirect you to that symbols index information.

DJIA: LOSING -45.08%

S&P 500: WINNING +0.48%

NYSE COMPOSITE: WINNING +0.35%

NASDAQ: WINNING +0.84%

Using this information you should be able to start your assessment of market risk, sentiment, and overall asset allocation trends. If you're having trouble understanding any of this information or want to go over how this information can help you make investment decisions, feel free to email me with your questions.

Gold For Gold

Looks to me that the gold trend may be a bit exhausted. I bet all this selling is from profit taking by the big holders who bought it at $800/oz some years ago. Ever think about that? Well just in case you didn't that's okay, I'm here to show you what to do with gold at this point. If you're not buying physical metals for your own personal stash, you're tripping and if you think somehow gold is going to collapse and become worthless, you must not know what your computer parts are made from. In this lesson I'll be going over golds history and its future.

1st of all the prices we're seeing these days are the same prices we were seeing at this same time last year. That means we are in a range. It may be a huge range to some but consider the instrument we are referencing and the age of its history. On a 50 year chart this range probably isn't too big at all; and seeing as how gold is long-term investment type of thing, I'd say a 50 year chart is in order to view. But I wont do that to you, I'll just bring up a daily chart that shows us a little more than a year because that's all we need anyway.